John Gorlow

| Feb 15, 2024

Following the broad-based Q4 stock rally, investors entered 2024 with both hope and caution. Trading was choppy, but by the end of January, the S&P 500 Index notched several new highs and a third consecutive monthly gain. For the first month of the year, at least, confidence in the strength of the U.S. economy outweighed concerns about monetary policy. Whether that confidence will remain intact is uncertain.

Within developed markets, the S&P 500 once again led the way with a 1.6% gain for the month. The Dow climbed 1.2%. The Nasdaq, weighted down by declines in Tesla and Apple, gained 1%. It’s noteworthy that one trend did not continue, as stocks and bonds that had moved more or less in tandem over the past year began to separate. An index of global bonds dropped 1.38%.

It might feel like the party is winding down after the S&P 500’s stellar 26% return in 2023. But history suggests otherwise. JP Morgan recently analyzed what happened following S&P 500 calendar-year gains of 20% or more, going back more than 50 years. “Out of 14 other instances since 1970, 11 of them ended the next year higher. What’s more, the median return for the following year was 13.7%. Of course, past performance is no guarantee of future results. But if you map that trend on to 2023’s year-end close of 4,769, it puts the S&P 500 north of 5,400 in December (Financial Times, 30-January 2024).”

One concern is that current stock valuations are not cheap. Financial pundits have pointed to the fact that just seven mega-cap tech stocks accounted for more than 60% of the S&P 500 return last year, and these stocks seem very expensive relative to the broader market. But JP Morgan notes that “Magnificent Seven valuations seem less excessive considering their distinctive strengths: strong free cash flow growth (14.5% compound annual growth rate versus 7% for the rest of the index since 2018), superior profit margins (19% versus 9% for the rest of the index) and higher earnings growth expectations.”

What could derail the rosy predictions for 2024? Well, plenty. Stubborn inflation, for instance. The latest inflation news was an unwelcome surprise, and caused the S&P 500 to shed more than 500 points on February 13. Concerns with which investors approached the new year quickly resurfaced. If interest rates remain higher for longer than expected, how will that affect corporate earnings, the vulnerable commercial real estate market, banks, and small businesses? Will U.S. economic growth take a hit?

There are plenty of other “what-ifs” that could upend markets in 2024, including geopolitical unrest, spreading wars, dire effects of climate change and unforeseen weather events, and more. Of course, unforeseen events have shaped the markets ever since equities were first traded. For long-term investors, what happens to markets in 2024 ultimately doesn’t matter. With a diversified portfolio built on personal goals, a timeline and appropriate risk, one can hope for a solid year for the markets, yet feel no discomfort if things turn out differently. It won’t always be smooth sailing, and that’s to be expected.

Remember to respect the process. Focus on hedging your liabilities, meeting your essential spending requirements, and funding your long-term objectives. Place your trust in a total market approach diversified across categories and asset classes for greater expected returns and higher confidence long-term outcomes.

January Market Review

Courtesy of Avantis Investors

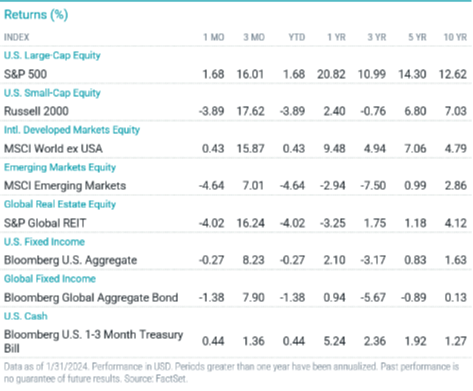

Global stocks were mixed in January. U.S. stocks broadly advanced and outperformed developed and emerging market indices. Yields were volatile, and U.S. bonds declined slightly.

Stocks sold off at the end of January after Fed Board Chair Jerome Powell indicated a March rate cut was likely off the table, though cuts later in 2024 were still probable.

The S&P 500 Index returned 1.68% in January, its third consecutive monthly gain, and reached several record highs during the month.

Sector results within the S&P 500 were mixed, with six sectors declining and five advancing. Real estate and materials were the largest decliners, and communication services and information technology were the top performers.

Non-U.S. developed markets stocks advanced slightly for the month amid weak to flat economic growth and persistent inflation. Emerging market stocks declined sharply.

U.S. Treasury yields were volatile in January, and the broad bond market declined fractionally.

US Stocks

U.S. stocks broadly advanced in January and outperformed non-U.S. stocks, but size and style indices delivered mixed results.

Large-cap stocks gained more than 1% and sharply outperformed small-caps, which declined almost 4%.

Growth stocks outperformed value stocks. Among large-caps, growth stocks were up nearly 2.5%, while value stocks were nearly flat. Among small-caps, growth and value stocks declined.

International Stocks

The broad international developed markets stocks index increased slightly in January.

Large-cap stocks rose fractionally and outperformed small-caps, which declined nearly 2%.

Growth stocks outpaced value stocks among large-caps, but underperformed value stocks in small-caps.

Emerging Market Stocks

The broad emerging markets stock index underperformed developed markets, declining almost 5% in January.

Emerging market small-cap stocks fared better than large-caps.

Value stocks outperformed growth stocks across capitalizations. Within emerging markets, small-cap value stocks were top performers, declining 0.69%.

Fixed-Income Returns

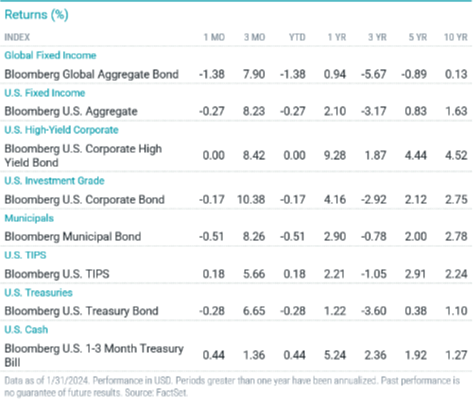

Treasury yields were volatile in January but ended the month only slightly changed. After finishing 2023 on a strong note, bonds declined slightly in January.

The Bloomberg U.S. Aggregate Bond Index returned -0.27% in January, as all index sectors declined fractionally. Investment-grade corporates outperformed the index, while Treasuries and MBS underperformed.

Against a backdrop of robust fourth-quarter economic growth and expectations for Fed interest rate cuts, U.S. Treasury yields were volatile. The 10-year Treasury yield ended January at 3.92%, 4 bps higher than the prior month-end. The two-year Treasury yield dropped 4 bps to 4.21%.

Credit spreads were also volatile. Investment-grade spreads ended the month slightly tighter, while high-yield spreads widened. The high-yield corporate index was flat for the month.

The Fed held rates steady. Fed Chair Jerome Powell noted rates would stay at current levels until the Fed is confident annual inflation is moving sustainably to target while also stating further hikes are unlikely. This news reduced market hopes for a March rate cut, but expectations for cuts later in 2024 remained intact.

Annual headline CPI climbed to 3.4% in December, the first increase since August. Core CPI eased slightly to 3.9%, with shelter costs continuing to drive the gain. The annual core PCE price index, the Fed’s preferred inflation gauge, moderated to 2.9%.

Municipal bonds declined fractionally and underperformed Treasuries.

Inflation break-even rates increased in January, and TIPS returns advanced slightly.

As always, if you have questions about your portfolio or allocations, please contact us. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell