John Gorlow

| Nov 20, 2023

Holiday jubilation came early to Wall Street last week as positive news about inflation led to a third straight winning week. The overall Consumer Price Index for October dropped to 3.2% annually from 3.7% the previous month—and from a peak, in this business cycle, of 9.1% in June 2022.

At the same time, core inflation, which excludes fuel and food prices, fell to 4% in October, the smallest increase since September 2021. Bond prices rallied sharply, as the yield on the 10-year Treasury dipped to 4.43%. A few weeks ago, it was above 5%, its highest since 2007.

Investors’ hopes for a Fed pivot towards lower short-term interest rates fueled the benchmark S&P 500 to rise sharply, climbing nearly 10% from its October lows, and propelled year-to-date returns on the bellwether index to more than 19%.

Time to pop open the champagne? Depends on what data you’re digesting. On the one hand, soft jobs data, slowing inflation, and a resilient economy are rekindling hopes for an economic soft-landing, which seemed nearly impossible a year ago. On the other hand, a more troubling downturn could be on the way. Some analysts predict large ripple effects from rising commercial property market foreclosures and a coming wave of corporate bankruptcies. Mounting debt-refinancing issues face even the most powerful private equity firms, and could lead to deeper problems for investors.

What we’re seeing now is great news, to be sure, but it doesn’t mean we’re out of the woods yet. Even Fed Chair Jerome Powell acknowledges this. All of which is to say, hope is warranted, but maybe not too much. Keep that champagne on ice.

October Market Review

Courtesy of Avantis Investors

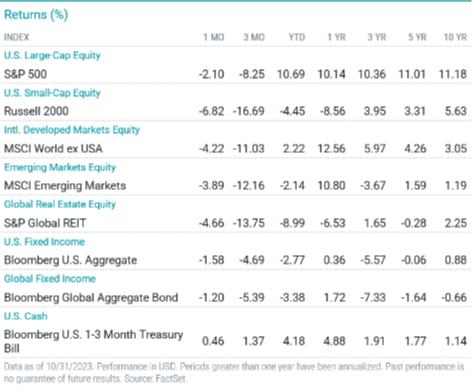

Global and U.S. stocks declined for the third consecutive month in October, but most broad indices maintained year-to-date gains. Yields continued to rise, and U.S. bonds logged negative returns.

Robust economic data released in October bolstered the Fed’s “higher for longer” interest rate outlook. U.S. stocks declined against a backdrop of higher rates, mixed earnings and continued geopolitical tensions.

The S&P 500 Index returned -2.1% for the month, pushing its year-to-date return to 10.69%. The utilities sector was the only S&P 500 Index component to deliver a gain for the month.

Non-U.S. stocks generally experienced steeper monthly declines. Amid economic concerns, rising bond yields and the Israel-Hamas war, non-U.S. developed markets stocks declined. Emerging markets stocks declined but outperformed non-U.S. developed markets stocks.

The Commerce Department reported third-quarter U.S. GDP surged to an annualized pace of 4.9%. Jumps in consumer spending and inventory rebuilding drove much of the gain.

The pace of annualized U.S. headline inflation remained unchanged from August to September at 3.7%, while core inflation eased from 4.3% to 4.1%. Inflation slowed in Europe and held steady in the U.K., but consumer prices remained above central bank targets.

While stocks broadly declined, U.S. and non-U.S. large-cap stocks fared better than small-caps. Growth stocks outperformed among large-caps and lagged in the small-cap space.

U.S. Treasury yields continued to climb, and the broad bond market declined for the month.

U.S. Stock Markets

U.S. stocks broadly declined for the month, but most indices maintained solid year-to-date gains.

Large-cap stocks fared better than small-caps in October. Year to date, large-caps advanced and outpaced their declining small-cap peers.

Growth stocks outperformed value stocks among large-caps but underperformed in the small-cap arena. Year to date, growth stocks maintained a performance edge, notably among large-caps, where growth stocks gained 23% versus -2% for value.

Non-U.S. Developed Markets

The broad international developed markets stocks index declined for the month but held onto a modest year-to-date gain.

Large-cap stocks declined but fared better than small-caps for the month. Year to date, large-caps advanced and outperformed their small-cap peers, which declined.

In October, growth stocks outpaced value stocks among large-caps but underperformed in the small-cap space. Year to date, the value style outperformed across the board.

Emerging Markets

The broad emerging markets stock index declined in October, pushing its year-to-date return negative.

Large-cap stocks fared better than small-caps in October. Year to date, small-caps rose and outperformed large-caps, which declined.

For the month, growth stocks outpaced value stocks among large-caps but underperformed among small-caps. Year to date, value stocks outperformed growth stocks in the large-cap arena and underperformed among small-caps.

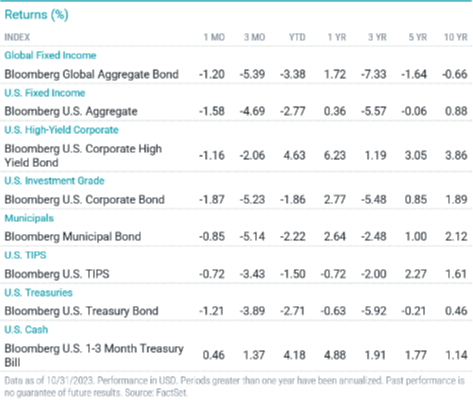

Fixed-Income Returns

Treasury yields continued to rise in October, contributing to another monthly decline for the broad U.S. bond index. Bonds also retreated for the year-to-date period.

The Bloomberg U.S. Aggregate Bond Index returned -1.58% in October, as all index sectors declined. Alongside robust economic data and concerns about the sustainability of government finances, the yield on the 10-year Treasury note topped 5% for the first time since 2007.

Overall, the 10-year Treasury yield ended October at 4.93%, 35 bps higher than the end of September. The two-year Treasury yield rose 5 bps to 5.1%.

Spreads widened, and investment-grade corporate and mortgage-backed bonds underperformed Treasuries and the broad bond index. Meanwhile, high-yield corporates declined but outperformed investment-grade corporates.

Looking ahead to the Fed’s November monetary policy meeting, the futures market expected the Fed to hold rates steady for the second consecutive policy meeting.

Annual headline CPI remained unchanged in September at 3.7%. Core inflation eased slightly to 4.1%. The shelter component, which rose 7.2%, continued to account for more than 70% of core CPI’s annual gain.

Municipal bond (muni) yields rose in October, and muni returns were negative for the month and year to date. However, munis continued to outperform Treasuries.

Inflation breakeven rates rose in October, and TIPS outperformed nominal Treasuries.

As always, if you have questions about your portfolio or allocations, please contact us. I am here to help.

Finally, all of us at Cardiff Park Advisors wish you, your family and loved ones a healthy, safe and happy Thanksgiving.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell