John Gorlow

| Mar 04, 2020

In stark contrast to the beginning of 2019, global stocks closed out January with a 1.1% loss versus a gain of 7.9% in the same period last year. US stocks recorded their first month-over-month drop in recent months as investors were left with uncertainties surrounding the outcome of the Trump impeachment proceedings, tensions with Iran, and the Coronavirus (COVID 19) outbreak. The US Federal Open Market Committee met and left its interest rates and policy unchanged. The earnings outlook remained favorable. Gold rallied almost 4% to close at $1,593. The Bloomberg Commodity Index dropped over 7% with crude oil prices plunging over 15%. Bond prices climbed as the Ten-year US Treasury closed sharply lower at 1.51%, down from last month’s 1.92%.

In stark contrast to the beginning of 2019, global stocks closed out January with a 1.1% loss versus a gain of 7.9% in the same period last year. US stocks recorded their first month-over-month drop in recent months as investors were left with uncertainties surrounding the outcome of the Trump impeachment proceedings, tensions with Iran, and the Coronavirus (COVID 19) outbreak. The US Federal Open Market Committee met and left its interest rates and policy unchanged. The earnings outlook remained favorable. Gold rallied almost 4% to close at $1,593. The Bloomberg Commodity Index dropped over 7% with crude oil prices plunging over 15%. Bond prices climbed as the Ten-year US Treasury closed sharply lower at 1.51%, down from last month’s 1.92%.

There’s always something to rattle the markets. Wise investors understand that, and don’t let the news derail their investment strategy. But when bond yields sink, even disciplined investors may be tempted to jump to dividend-paying stocks as an alternative for generating cash. This month we look at the pros and cons of that approach. (Hint: there is no free lunch.) First, a look at January’s market performance.

January Market Report

World Asset Classes

The MSCI All Country World Index returned negative -1.1% bringing trailing twelve-month returns on the global benchmark to 16.04%. US stocks were the top performers, followed by international developed and emerging market equities, respectively.

US Stocks

US equities as measured by the S&P 500 Index returned negative -0.04%. For the one-year period, returns on the index were positive 21.68%. Looking back three years, returns on the US benchmark averaged 14.54%. Small caps underperformed large caps. Value stocks underperformed growth stocks marketwide.

International Developed Stocks

Developed markets outside the US as measured by the MSCI World-Ex USA Index returned negative 1.94%, underperforming the US and outperforming emerging markets. Trailing twelve-month returns on the international index were a healthy 12.12%. Small caps underperformed large caps. Growth outperformed value marketwide.

Emerging Markets Stocks

Emerging markets as measured by the MSCI Emerging Market Index returned negative -4.66%, bringing trailing twelve-month returns on the emerging markets index down to positive 3.81%. Small caps outperformed large caps and growth outperformed value.

Real Estate Investment Trusts (REITs)

US REITs outperformed international REITs returning 0.42% versus 0.22%, respectively. For the trailing twelve-months, US REITs returned 10.96% versus 12.92% for non-US REITs.

Fixed Income

The 10-year U.S. Treasury Bond closed at 1.51%, down from 1.92% last month. The 2-year Treasury bond closed at 1.33% down from 1.58% last month. The U.S. 10-year and 2-year Treasury Bond spread remained normal after inverting last fall, although out to 7 years, the US Treasury curve has slightly inverted versus last month. Barclay’s US Government Bond Index returned a healthy 2.42% for the period. Treasury inflation protected securities (TIPS) gained 2.1%. Barclay’s municipal bond index returned 1.8% for the month. Given the volatility in US stocks, Barclay’s US High Yield Corporate Bond Index underperformed, adding 0.03% for the period.

Feature Article

Yields of Dreams: A Closer Look at Dividends

Courtesy of DFA

As the gap between equity and bond yields narrows, investors may be tempted to turn to dividend-paying stocks as a way to generate income. But dividend strategies are not the only way to produce cash, and investors should be aware of the potential tradeoffs that accompany a focus on dividends.

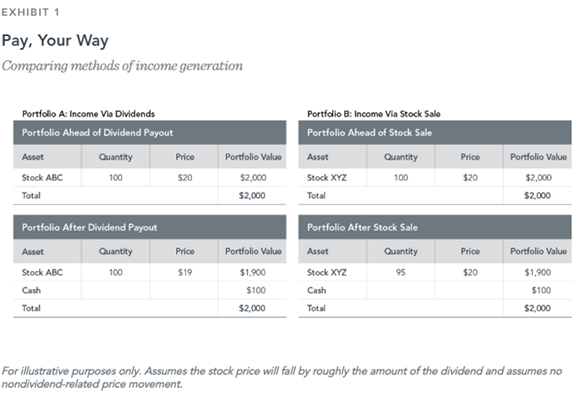

For stockholders who own dividend-paying shares, those payments arrive on a schedule (quarterly, in many cases). The cash to fund a dividend must come from somewhere, however. We know the price of a stock is potentially influenced by all expected future cash flows to shareholders. If cash is paid today in the form of a dividend, the stock price—and total market capitalization—of the issuing company may therefore fall, as the hypothetical Portfolio A in Exhibit 1 shows. That means, all else being equal, an investor who receives a dividend may also be left with a less valuable equity holding.

Cash Considerations

An alternative method of raising cash is to simply sell shares. Exhibit 1 compares the two methods of generating income by contrasting Portfolio A with the similarly valued hypothetical Portfolio B. While Portfolio A receives income through a dividend payout, Portfolio B generates it through a stock sale.

The investor in Portfolio A, in which a dividend is issued, ends up holding the same number of shares as were held prior to the dividend payout, but we assume that those shares have declined in value. The investor in Portfolio B holds a reduced number of shares that haven’t seen their value decrease as a result of a dividend payout. The two approaches arrive at the same place—both investors end up with $100 in cash and $1,900 in stock, notwithstanding potential trading costs or tax implications. But there are potential downsides to the dividend approach when contrasted with the stock-sale approach.

First, the average proportion of firms paying dividends in the US was about 52% from 1963 through 2019,1 meaning an investor focusing only on those stocks is missing out on nearly half of investible US companies. A second consideration is that a dividend’s value, while not subject to the same degree of fluctuation as a stock price, isn’t guaranteed. Just 10 years ago, more than half of dividend-paying firms cut or eliminated those payouts following the financial crisis.2 More recently, a company that had consistently paid dividends for more than a century, General Electric, slashed its payout to just one cent a share,3 and the UK’s Vodafone Group cut its full year dividend for the first time in two decades.4 Third, investors may give up flexibility in terms of the timing and the size of the payout when they rely on company-issued dividends. With stock sales, an investor determines the amount and schedule of the income.

Total Return

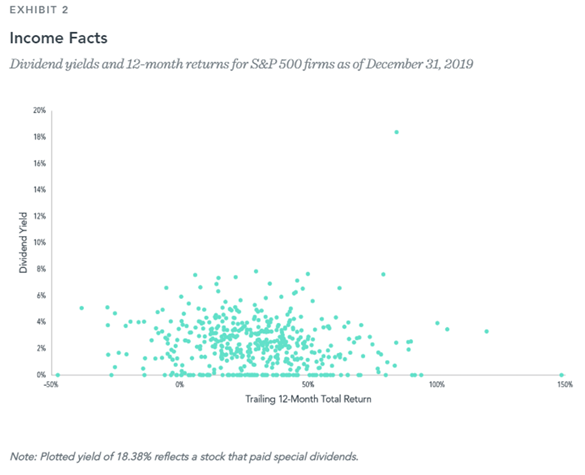

When considering an investment, it is also important to assess total return, which accounts for capital appreciation (or loss) alongside dividend income. High dividend yields may not lead to high total returns. Exhibit 2 plots the trailing 12-month returns of S&P 500 Index constituents as of December 31, 2019, with each dot representing a company. It’s clear that companies with greater dividend yields, the dots located higher up the vertical axis, weren’t consistently those with a higher total return over that period.

Source: Dimensional calculations using Bloomberg data. For constituents with reported returns of less than one year, returns shown since earliest date available. S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Dividend yield is calculated as the sum of dividends paid in calendar year t divided by end of year t-1 price.

Income generation may be a priority for some investors, but other important investment considerations, such as diversification and flexibility, needn’t fall victim to that aim. While the use of stock sales instead of dividends to create cash flow may involve trading costs and tax considerations, those concerns may be offset by the benefits of investing in companies that don’t currently pay dividends. An approach focused on income derived through dividends may not be the most desirable choice when weighing broader investment goals.

Do you have questions or concerns? Call me, I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

jgorlow@cardiffpark.com

FOOTNOTES

1. Source: Dimensional, using data from CRSP. Stocks are sorted at the end of each June based on whether a dividend was issued in the preceding 12 months.

2. Stanley Black, “Global Dividend-Paying Stocks: A Recent History” (white paper, Dimensional Fund Advisors, March 2013).

3. Janet Babin, “GE cuts dividend to a penny per share. Why bother keeping it at all?” Marketplace, American Public Media, October 30, 2018.

4. Adrià Calatayud, “Vodafone cuts dividend after swinging to 2019 loss.” MarketWatch, May 14, 2019.