John Gorlow

| Jul 17, 2019

You may have heard about “opportunity zones,” real estate hot spots that are attracting developers, fund managers and investors. Got $1,000,000 in capital gains? You could roll those capital gains into a “Qualified Opportunity Fund (QOF)” to defer or reduce current tax obligations and eliminate future capital gains! One catch: your money has to be tied up for ten years to reap the full benefits. Also, there’s no guarantee that your $1,000,000 investment will make a dime. We’ll look at the benefits and potential perils of this latest real estate investment craze after a review of Q2 market results.

You may have heard about “opportunity zones,” real estate hot spots that are attracting developers, fund managers and investors. Got $1,000,000 in capital gains? You could roll those capital gains into a “Qualified Opportunity Fund (QOF)” to defer or reduce current tax obligations and eliminate future capital gains! One catch: your money has to be tied up for ten years to reap the full benefits. Also, there’s no guarantee that your $1,000,000 investment will make a dime. We’ll look at the benefits and potential perils of this latest real estate investment craze after a review of Q2 market results.

Q2 2019 Market Report

Courtesy of DFA

Despite mounting fears of an economic slowdown that pushed bond yields down globally, Wall Street closed the books on June with a sharp about-face from a volatile May.

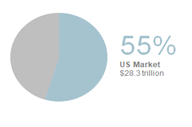

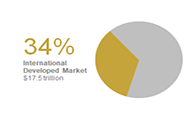

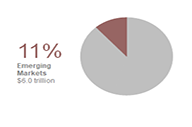

World Asset Classes

Equity markets around the globe posted positive returns for the quarter. Looking at broad market indices, US equities outperformed non-US developed and emerging markets during the quarter. Value stocks outperformed growth stocks in emerging markets but underperformed in developed markets, including the US. Small caps underperformed large caps in all regions. REIT indices underperformed equity market indices in both the US and non-US developed markets. 1

|

World Asset Classes

|

YTD

|

|

S&P 500 Index

|

4.3

|

|

Russell 1000 Index

|

4.25

|

|

Russell 3000 Index

|

4.1

|

|

Russell 1000 Value Index

|

3.84

|

|

MSCI World ex USA Index (net div.)

|

3.79

|

|

Bloomberg Barclays US Aggregate Bond Index

|

3.08

|

|

MSCI All Country World ex USA Index (net div.)

|

2.98

|

|

S&P Global ex US REIT Index (net div.)

|

2.64

|

|

Russell 2000 Index

|

2.1

|

|

MSCI World ex USA Small Cap Index (net div.)

|

1.76

|

|

MSCI World ex USA Value Index (net div.)

|

1.74

|

|

Russell 2000 Value Index

|

1.38

|

|

MSCI Emerging Markets Value Index (net div.)

|

0.97

|

|

Dow Jones US Select REIT Index

|

0.82

|

|

MSCI Emerging Markets Index (net div.)

|

0.61

|

|

One-Month US Treasury Bills

|

0.6

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

-0.98

|

|

As of 6/30/2019

|

|

US Stocks

US equities outperformed both non-US developed and emerging markets equities. Small caps underperformed large caps in the US. Value underperformed growth in the US across large and small cap stocks.

US equities outperformed both non-US developed and emerging markets equities. Small caps underperformed large caps in the US. Value underperformed growth in the US across large and small cap stocks.

|

Ranked Returns for the Quarter

|

%

|

|

Russell 1000 Growth Index

|

4.64

|

|

Russell 1000 Index

|

4.25

|

|

Russell 3000 Index

|

4.10

|

|

Russell 1000 Value Index

|

3.84

|

|

Russell 2000 Growth Index

|

2.75

|

|

Russell 2000 Index

|

2.10

|

|

Russell 2000 Value Index

|

1.38

|

|

As of 6/30/2019

|

|

|

Period Returns (%)

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Russell 1000 Growth Index

|

21.49

|

11.56

|

18.07

|

13.39

|

16.28

|

|

Russell 2000 Growth Index

|

20.36

|

-0.49

|

14.69

|

8.63

|

14.41

|

|

Russell 1000 Index

|

18.84

|

10.02

|

14.15

|

10.45

|

14.77

|

|

Russell 3000 Index

|

18.71

|

8.98

|

14.02

|

10.19

|

14.67

|

|

Russell 2000 Index

|

16.98

|

-3.31

|

12.30

|

7.06

|

13.45

|

|

Russell 1000 Value Index

|

16.24

|

8.46

|

10.19

|

7.46

|

13.19

|

|

Russell 2000 Value Index

|

13.47

|

-6.24

|

9.81

|

5.39

|

12.40

|

|

As of 6/30/2019

|

|

* Annualized

|

International Developed Stocks

In US dollar terms, developed markets stocks outside the US outperformed emerging markets equities but underperformed the US equity market during the quarter. Small caps underperformed large caps in non-US developed markets. Value underperformed growth across large and small cap stocks.

In US dollar terms, developed markets stocks outside the US outperformed emerging markets equities but underperformed the US equity market during the quarter. Small caps underperformed large caps in non-US developed markets. Value underperformed growth across large and small cap stocks.

|

Ranked Returns for the Quarter

|

%

|

|

MSCI World ex USA Growth Index (net div.)

|

5.76

|

|

MSCI World ex USA Index (net div.)

|

3.79

|

|

MSCI World ex USA Small Cap Index (net div.)

|

1.76

|

|

MSCI World ex USA Value Index (net div.)

|

1.74

|

|

As of 6/30/2019

|

|

|

Period Returns (%)

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

MSCI World ex USA Growth Index (net div.)

|

18.89

|

4.36

|

9.42

|

4.02

|

7.81

|

|

MSCI World ex USA Index (net div.)

|

14.64

|

1.29

|

9.01

|

2.04

|

6.75

|

|

MSCI World ex USA Small Cap Index (net div.)

|

12.88

|

-6.17

|

8.38

|

3.39

|

9.19

|

|

MSCI World ex USA Value Index (net div.)

|

10.38

|

-1.80

|

8.54

|

0.01

|

5.62

|

|

As of 6/30/2019

|

|

* Annualized

|

Emerging Markets Stocks

In US dollar terms, emerging markets underperformed developed markets, including the US. Value stocks generally outperformed growth stocks. Small caps underperformed large caps.

In US dollar terms, emerging markets underperformed developed markets, including the US. Value stocks generally outperformed growth stocks. Small caps underperformed large caps.

|

Ranked Returns for the Quarter

|

%

|

|

MSCI Emerging Markets Value Index (net div.)

|

0.97

|

|

MSCI Emerging Markets Index (net div.)

|

0.61

|

|

MSCI Emerging Markets Growth Index (net div.)

|

0.26

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

-0.98

|

|

As of 6/30/2019

|

|

|

Period Returns (%)

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

MSCI Emerging Markets Growth Index (net div.)

|

12.33

|

-2.44

|

11.22

|

3.85

|

6.94

|

|

MSCI Emerging Markets Index (net div.)

|

10.58

|

1.21

|

10.66

|

2.49

|

5.81

|

|

MSCI Emerging Markets Value Index (net div.)

|

8.87

|

5.04

|

10.02

|

1.03

|

4.60

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

6.70

|

-5.12

|

5.46

|

0.53

|

5.86

|

|

As of 6/30/2019

|

|

* Annualized

|

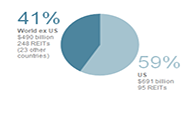

Real Estate Investment Trusts (REITs)

Non-US real estate investment trusts outperformed US REITs in US dollar

|

Ranked Returns for the Quarter

|

%

|

|

Dow Jones US Select REIT Index

|

0.82

|

|

S&P Global ex US REIT Index (net div.)

|

2.64

|

|

As of 6/30/2019

|

|

|

Asset Class

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Dow Jones US Select REIT Index

|

16.67

|

9.75

|

3.73

|

7.61

|

15.40

|

|

S&P Global ex US REIT Index (net div.)

|

14.68

|

7.78

|

4.79

|

3.62

|

9.84

|

|

As of 6/30/2019

|

|

* Annualized

|

Commodities

The Bloomberg Commodity Index Total Return declined 1.19% in the second quarter of 2019. Corn and wheat led performance, returning 14.24% and 13.36%, respectively. Natural gas and cotton were the worst performers, declining by 16.67% and 14.72%, respectively.

|

Asset Class

|

QTR

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Bloomberg Commodity Index Total Return

|

-1.19

|

5.06

|

-6.75

|

-2.18

|

-9.15

|

-3.74

|

|

As of 6/30/2019

|

|

|

* Annualized

|

Fixed Income

Interest rates decreased in the US Treasury fixed income market during the second quarter. The yield on the 5-year Treasury note declined by 47 basis points (bps), ending at 1.76%. The yield on the 10-year Treasury note fell by 41 bps to 2.00%. The 30-year Treasury bond yield decreased by 29 bps to finish at 2.52%. On the short end of the curve, the 1-month Treasury bill yield decreased to 2.18%, while the 1-year T-bill yield decreased by 48 bps to 1.92%. The 2-year T-note yield finished at 1.75%, decreasing 52 bps. In terms of total returns, short-term corporate bonds increased by 2.09%. Intermediate-term corporate bonds had a total return of 3.13%. The total return for short-term municipal bonds was 1.12%, while intermediate munis returned 1.98%. Revenue bonds outperformed general obligation bonds. 2

|

Bond Yields Across Issuers

|

(%)

|

|

10-Year US Treasury

|

2.00

|

|

State and Local Municipals

|

2.90

|

|

AAA-AA Corporates

|

2.68

|

|

A-BBB Corporates

|

3.32

|

|

As of 6/30/2019

|

|

|

Period Returns (%)

|

QTR

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Bloomberg Barclays US Gov’t Bond Index Long

|

6.00

|

10.92

|

12.28

|

1.42

|

5.68

|

6.54

|

|

Bloomberg Barclays US Aggregate Bond Index

|

3.08

|

6.11

|

7.87

|

2.31

|

2.95

|

3.9

|

|

Bloomberg Barclays US TIPS Index

|

2.86

|

6.15

|

4.84

|

2.08

|

1.76

|

3.64

|

|

Bloomberg Barclays US High Yield Corp Bnd Indx

|

2.50

|

9.94

|

7.48

|

7.52

|

4.70

|

9.24

|

|

Bloomberg Barclays Municipal Bond Index

|

2.14

|

5.09

|

6.71

|

2.55

|

3.64

|

4.72

|

|

FTSE World Gov’t Bond Idx 1-5 Years

|

1.92

|

2.27

|

2.57

|

0.67

|

-0.76

|

0.53

|

|

FTSE World Gov’t Bond Ide 1-5 Years (hedged)

|

1.51

|

2.69

|

4.44

|

1.85

|

1.84

|

1.86

|

|

ICE BofAML 1-Year US Treasury Note Index

|

0.94

|

1.76

|

2.98

|

1.43

|

1.02

|

0.76

|

|

ICE BofAML US 3-Month Treasury Bill Index

|

0.64

|

1.24

|

2.31

|

1.38

|

0.87

|

0.49

|

|

As of 6/30/2019

|

|

|

* Annualized

|

Global Fixed Income

Interest rates in the global developed markets generally decreased during the quarter. Longer-term bonds generally outperformed shorter-term bonds in global developed markets. Short- and intermediate-term nominal interest rates were negative in Germany and Japan. 3

|

Changes in Yields (bps)

|

1Y

|

5Y

|

10Y

|

20Y

|

30Y

|

|

US

|

-45.30

|

-48.80

|

-41.40

|

-30.90

|

-29.00

|

|

UK

|

2.80

|

-10.50

|

-13.60

|

-11.00

|

-6.00

|

|

Germany

|

-8.50

|

-19.30

|

-24.00

|

-30.10

|

-29.90

|

|

Japan

|

-0.90

|

-5.80

|

-6.70

|

-11.00

|

-15.00

|

|

since 3/31/2019

|

|

|

|

|

|

Impact of Diversification

These portfolios illustrate the performance of different global stock/bond mixes and highlight the benefits of diversification. Mixes with larger allocations to stocks are considered riskier but have higher expected returns over time. 4

|

Ranked Returns for the Quarter

|

%

|

|

100% Treasury Bills

|

0.60

|

|

25/75

|

1.47

|

|

50/50

|

2.30

|

|

75/25

|

3.08

|

|

100% Stocks

|

3.80

|

|

As of 6/30/2019

|

|

|

Period Returns (%)

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

10-Yr STDEV¹

|

|

100% Stocks

|

16.6

|

6.32

|

12.22

|

6.74

|

10.73

|

13.48

|

|

75/25

|

12.69

|

5.56

|

9.53

|

5.36

|

8.25

|

10.11

|

|

50/50

|

8.82

|

4.62

|

6.8

|

3.91

|

5.7

|

6.74

|

|

25/75

|

4.98

|

3.51

|

4.06

|

2.39

|

3.09

|

3.37

|

|

100% Treasury Bills

|

1.18

|

2.23

|

1.3

|

0.8

|

0.43

|

0.21

|

|

As of 6/30/2019

|

|

* Annualized

|

Feature Article

A Shiny New Opportunity

In February 2018, Donald Trump introduced his daughter Ivanka at an Oval Office gathering to plug a brand-new real estate investment vehicle. “Creating the incentive to bring capital into communities that are currently being overlooked is just a tremendous opportunity,” Ivanka told an enthusiastic audience. She was referring to opportunity zones, a newly hatched investment opportunity buried in the 2017 tax overhaul bill.

You’d need a crystal ball to determine how these investments will pan out. But since when has the failure to envision future scenarios stopped investors from hopping on the latest real estate bandwagon?

Opportunity zones, defined as areas in which the poverty rate is at least 20%, were carved out of 2010 census data. In 2010, 32,000 tracts—40% of the total 73,000 census tracts across the USA—met that standard. States were then asked to nominate up to 25% of these qualifying tracts or similar tracts as “qualified opportunity zones.” Today there are 8,700 qualified opportunity zones across the US.

The opportunity zone program is built on the idea that tax incentives for investors can reverse economic decline and renew development in American communities left behind by the Great Recession. Participating areas could tap into pools of private equity to revitalize their communities and create jobs. But that vision may not match the unfolding reality, in part because the law is vaguely written.

By way of background, the zones are broadly defined to include not only blighted areas but areas contiguous to blighted areas that may be rapidly gentrifying and are already relatively affluent. The new law does not specify that local residents must benefit in any way from opportunity zone investment, though recent proposed rules from the US Treasury could encourage local employment by opening doors to tax-favored investment in other businesses operating in the qualified areas.

Currently dozens of opportunity zone funds are competing to capture a tidal wave of private equity dollars. Investors are looking for attractive opportunities for growth coupled with hefty breaks on capital gain taxes. It’s safe to assume that a good deal of investor interest has little to do with serving the public good, and some see a dark side to the feeding frenzy. Ivanka Trump herself may have more than an altruistic interest, as her husband Jared Kushner has a large stake in Cadre, a real estate firm with ambitious plans to launch opportunity zone funds for major projects from Miami to Los Angeles.

Program proponents claim that opportunity funds will benefit communities by reducing poverty, increasing employment, and spurring economic growth. Detractors say just the opposite: that the program is a tax giveaway that will stimulate growth in up-and-coming communities that are destined to attract investment in any case. Detractors also point to the lack of protections for low- and middle-income residents who are the first to be victimized by gentrification. If low- and middle-income housing is not built (and the law does not require it), poorer residents will be pushed out. The unintended effect may be to decrease opportunities for those who need them most.

Looking at potential scenarios from an economic vantage point, tax benefits certainly could encourage purchase and rehabilitation of residential property and expansion of local businesses. But many investors are naturally reluctant to make speculative investments in impoverished areas where rents and property values are stagnant. This is why the highest returns to investors, and thus the largest tax subsidies, are likely to flow to the fastest gentrifying areas with the largest capital gains potential.

For example, some opportunity zones may look like Oakland, California, a sprawling city with pockets of deep poverty facing an onslaught of gentrification. Thousands of new apartment units are being built in and around the downtown area to accommodate tech-worker overflow from San Francisco. Packed restaurants and bars, bakeries selling $10 artisanal bread, and bustling clubs are quickly replacing auto repair shops and mom-and-pop stores. While many opportunity zones are indeed in blighted areas, Oakland is not an outlier in the opportunity zone world.

Let’s look at how investor tax breaks work, and what to consider if you’re interested in jumping into the opportunity zone arena.

Amazing Tax Breaks

Opportunity zones offer rich tax breaks to investors, enabling them to defer or substantially reduce existing capital gains taxes (from both real estate and stocks) if those gains are invested in a qualified opportunity zone fund (QOF) within 180 days. By moving realized capital gains into a qualified Opportunity Fund within 180 days of the asset sale, investors can defer paying capital gains taxes on that gain until December 31, 2026, or until they sell their Opportunity Fund investment, whichever is earlier.

Once invested, the tax on the deferred capital gain is reduced by 10% if the QOF is held for five years, and an additional 5% if the QOF is held for seven years. So, the tax to an investor on a deferred $1,000,000 capital gain (assuming a $238,000 tax liability) would be reduced by $23,800 if the QOF is held for five years, or $35,700 if held for seven years. That means by holding an Opportunity Fund investment for 7 years prior to December 31, 2026, an investor can reduce their tax liability on the deferred capital gains invested in the Opportunity Fund by 15%.

Investors get an even better deal on capital gains that may accrue from investing in an opportunity zone fund. If an investor holds their Opportunity Fund investment for another 3 years (10 years total), they can expect to pay zero dollars in capital gains taxes on any appreciation from their original Opportunity Fund investment. That’s because Opportunity Fund gains earned from Opportunity Zone investments can qualify for permanent exclusion from the capital gains tax if the investment is held for at least 10 years.

The net effect is that some capital gains can be deferred and reduced, while others can be completely eliminated over a ten-year holding period. Analysts say these are some of the richest tax breaks they’ve ever seen.

Some advisors may recommend QOFs as an alternative to 1031 exchanges. An investor using this approach can bifurcate their cost basis and their earnings, ‘pocketing’ the tax-free basis, and reinvesting only the gain into the QOF. This may seem well-founded until investors look at the potential pitfalls of QOFs.

The Question of Risk

The Ten-Year Risk: Tying up your money in a real estate fund for ten years is risky. There’s no way to know if the properties or other investments in QOFs will increase in value. At ten years there might be a rush to the exits if property values deflate. Is that future risk worth deferring current capital gains savings? Remember that most developers want to develop, then sell, rather than hold on to property for ten years or more. That’s an issue of no small significance if many developers simultaneously enter and exit an opportunity zone, building out of proportion to future demand.

The Management Expertise Risk: Who is managing that QOF? Is there a clear investment strategy, timeline and willingness to hold on to a portfolio? How much money is the fund team removing from your pocket in management fees and profits? While you carry the intermediary risk, someone else is profiting. You deserve to know the cost and whether the team you’re invested with is worth it.

The Pricing Mis-Assumption Risk: Many investors fail to recognize that the favorable tax status of QOF projects is information available to all, and therefore already incorporated into prices at which opportunity funds can make investments. To illustrate, if investors were seeking a 6% before-tax return for a specific level of risk, they would likely bid up pricing for underlying QOF investments to reflect an appropriate after-tax rate—say 4%. In other words, the tax benefit, while technically correct, doesn't necessarily result in better returns for investors because they are paying a higher price to start with. Indeed, since the program was announced, many opportunity zones have seen qualified property values jump by 20% or more in anticipation of interest from opportunity zone developers and investors.

The Tax Law Risk: In the 1980s millions of investors were lured into real estate limited partnerships that promised tax-sheltered investment gains. Markets were overdeveloped as inflation drove property values higher and higher. Savings and loans, insurance companies and pension funds jumped in, further adding to massive overbuilding. Then the tax law changed. Investors lost hundreds of millions of dollars. Lesson: tax laws can change again, and probably will. Changes may be initiated by the IRS when it perceives abuses or misinterpretation of the law.

The “Where to Invest” Question: As many pundits have noted, investing in a QOF requires real estate expertise and a whole lot more. National databases have been created to help sort out the options. But first you need to be clear on your objectives. For most investors, it’s all about tax savings, but that’s not true for all. Should you invest in a truly underdeveloped area, following an altruistic motive, or in an area like Brooklyn Heights, where the Kushner family owns property? (Condos in Brooklyn Heights already sell for millions.) Investing in the right markets is important for meeting either objective. Michael Tillman, an opportunity zone fund CEO, suggests that “The deals should be the same deals you’d be doing if they weren’t in an opportunity zone.” I like that advice.

I personally see many ways to get harmed: overpaying, investing in zones where savvy developers already own all the properties (giving them the chance to monetize at inflated prices), unforeseen events that could trigger a collapse in values, and the potential to be stuck with a tax bill from phantom income attributable to the project even if there hasn’t been an income distribution.

My advice: think twice about tax avoidance strategies. Remember the real estate debacle of the ‘80s. Be wary of shady tax-shelter promoters taking advantage of poorly written laws that could eventually land you in trouble. And please consider your long-term objectives. If you want to invest to help others, there are better and more direct ways than investing in an Opportunity Fund.

Do you have questions or comments? Call me. I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com

1. The S&P data is provided by Standard & Poor's Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2019, all rights reserved. Dow Jones data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg Barclays data provided by Bloomberg. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).

2. Yield curve data from Federal Reserve. State and local bonds are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofAML US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofAML US Corporates, BBB-A rated. Bloomberg Barclays data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2019 FTSE Fixed Income LLC, all rights reserved. ICE BofAML index data © 2019 ICE Data Indices, LLC. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

3. One basis point equals 0.01%. Source: ICE BofAML government yield. ICE BofAML index data © 2019 ICE Data Indices, LLC.

4. Asset allocations and the hypothetical index portfolio returns are for illustrative purposes only and do not represent actual performance. Global Stocks represented by MSCI All Country World Index (gross div.) and Treasury Bills represented by US One-Month Treasury Bills. Globally diversified allocations rebalanced monthly, no withdrawals. Data © MSCI 2019, all rights reserved. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).