John Gorlow

| May 20, 2019

Tongues were wagging when the Golden State Warriors’ Steph Curry entered Game 6 of the second-round playoffs against the Houston Rockets. Was the star losing his touch? Lately his shooting had been abysmal, despite averaging 27.3 points per game throughout the 2018 – 2019 regular season and 23.5 points over a ten-year career. Even so, fans were shocked when Curry failed to land a single shot in the first half of the game. Then came an astounding second half, when he lit up like a rocket (pardon the pun) to score 33 points, 23 of them in the fourth quarter alone. Herein lies a lesson in trusting the long-term average and ignoring day-to-day fluctuations. It’s good advice for investing, too. Read more after a review of April markets.

Tongues were wagging when the Golden State Warriors’ Steph Curry entered Game 6 of the second-round playoffs against the Houston Rockets. Was the star losing his touch? Lately his shooting had been abysmal, despite averaging 27.3 points per game throughout the 2018 – 2019 regular season and 23.5 points over a ten-year career. Even so, fans were shocked when Curry failed to land a single shot in the first half of the game. Then came an astounding second half, when he lit up like a rocket (pardon the pun) to score 33 points, 23 of them in the fourth quarter alone. Herein lies a lesson in trusting the long-term average and ignoring day-to-day fluctuations. It’s good advice for investing, too. Read more after a review of April markets.

April Market Report

World Asset Classes

Equity markets posted positive returns around the globe in April. The MSCI All Country World Index added 3.38% bringing its YTD return to 15.96%, its best start to the year since the index was launched in 1990. Looking at broad market indices, US equities outperformed non-US developed and emerging markets. Large caps outperformed small caps in the US and non-US developed and emerging markets. Value stocks generally underperformed growth stocks in all regions. REIT indices underperformed equity market indices in both the US and non-US developed markets.

US Stocks

US equities as measured by the S&P 500 index returned 4.05%, bringing year-to-date returns on the index to an above average 18.25%. Small caps underperformed large caps. Value underperformed growth in large caps but outperformed in small caps.

International Developed Stocks

Developed markets outside the US as measured by the MSCI World-Ex USA Index returned 2.83% in dollar terms, outperforming emerging markets but underperforming the US markets. Small caps slightly underperformed large caps. Value underperformed growth market-wide.

Emerging Markets Stocks

Emerging markets as measured by the MSCI Emerging Market Index returned 2.11% in dollar terms, underperforming developed markets, including the US. Value underperformed growth. Small caps underperformed large caps.

Real Estate Investment Trusts (REITs)

Real Estate returns were slightly negative for the period. US real estate investment trusts outperformed non-US REITs in US dollar terms.

Fixed Income

The 10-year U.S. Treasury Bond closed the month at 2.50%, up from last month's 2.41%. High yield bonds as measured by Bloomberg Barclays U.S. High Yield Corporate Bond Index returned 1.42%, outperforming investment grade corporate credits. Barclay’s US Government Bond Index fell 0.27%. Barclay’s Municipal Bond Index gained 0.38%. Oil increased to close at $63.38. Gold was down, closing at $1,282.70. Inflation expectations remain subdued. Volatility in the stock market continued to drop. After raising interest rates four times in 2018, Federal Reserve officials have played down the prospect of further rate hikes while voicing caution about the economic outlook.

Feature Article (Source material courtesy of DFA)

The Long Game

Since 1926, the US stock market has produced an average annual return of around 10%. Along the way investors experienced it all: debilitating losses of the great depression, soaring post-war gains, the dot-com meltdown, the mortgage meltdown and worldwide recession, and a handful of long and short periods of growth when annual gains reached 20% or more. Earning that average 10% gain meant $1000 invested in 1926 would be worth an inflation-adjusted $500,000 at the end of 2018. But to receive that reward, investors had to be willing to accept tremendous uncertainty.

The markets are random and unpredictable, and so are returns for the S&P 500 and every other sector. Exhibit 1 below, courtesy of DFA, shows calendar-year returns for the S&P 500 index since 1926. The shaded band shows the historical average, plus or minus 2 percentage points. The S&P 500 performed in this average range in just 6 of the past 93 years. In most years, returns were above or below the average by a good margin. There is no obvious pattern.

The randomness of the markets can be obscured by cherry-picking ten-year results. For instance, the dismal returns of 2008 have been wiped from ten-year tables. From December 2008 through December 2018, the S&P returned 11.26%. That looks much better than December 2000 through 2010 (-0.84%).

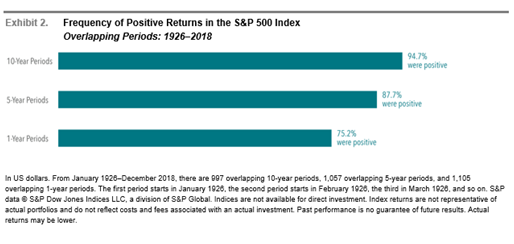

But Exhibit 2 below eliminates cherry-picking to reveal some favorable data for investors. By analyzing random rolling ten-year periods month-by-month, DFA demonstrates that the S&P 500 produced positive returns in 94.7% of any random rolling ten-year period since 1926. The same holds true for random rolling 5-year periods and one-year periods, though to a lesser degree. The likelihood of positive performance improves over time.

The charts above illustrate the wisdom of sticking to your own carefully constructed financial plan, remaining diversified and appropriately invested. Though trimming portfolio risk is sometimes warranted, it shouldn’t be done at the expense of achieving long-term financial goals. Before taking action, consider the random nature of markets, the 10% average S&P returns over 93 years, and the strong likelihood of positive returns over longer horizons. Be like Steph Curry. Ignore the noise when markets are down, and focus on what you’re capable of achieving if you remain focused and stay in the game.

Do you have questions or concerns? Call me. I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com