John Gorlow

| Oct 17, 2018

Lifted by a strong US economy, it was a profitable quarter for global markets, which returned a rewarding 4.28% as measured by the MSCI All Country World Index. But the gap between US stock returns and everywhere else was wide. Absent the 7.08% US return, global markets returned a meager 0.71% against a backdrop of lackluster growth, rising US interest rates, and a stronger dollar. International developed markets returned 1.31%, while emerging markets remained in the red at negative -1.09%. These performance measures may make some investors want to chase higher returns through portfolio reallocation. That’s not a good idea. Sooner or later, the tide will turn, and investors diversifying overseas will be rewarded. We’ll share more about why it’s important to remain diversified after a look at Q3 results.

Third Quarter 2018 Index Returns

(Courtesy of DFA)

World Asset Classes

Looking at broad market indices, the US outperformed non-US developed and emerging markets during the quarter. Small caps underperformed large caps in the US, non-US developed, and emerging markets. The value effect was positive in emerging markets but negative in the US and non-US developed markets. REIT indices underperformed equity market indices in both the US and non-US developed markets.

|

Period Returns (%)

|

QTD

|

|

S&P 500 Index

|

7.71

|

|

Russell 1000 Index

|

7.42

|

|

Russell 3000 Index

|

7.12

|

|

Russell 1000 Value Index

|

5.70

|

|

Russell 2000 Index

|

3.58

|

|

MSCI Emerging Markets Value Index (net div.)

|

3.44

|

|

Russell 2000 Value Index

|

1.60

|

|

MSCI World ex USA Index (net div.)

|

1.31

|

|

MSCI World ex USA Value Index (net div.)

|

1.15

|

|

Dow Jones US Select REIT Index

|

0.72

|

|

MSCI All Country World ex USA Index (net div.)

|

0.71

|

|

One-Month US Treasury Bills

|

0.48

|

|

Bloomberg Barclays US Aggregate Bond Index

|

0.02

|

|

MSCI World ex USA Small Cap Index (net div.)

|

-0.85

|

|

MSCI Emerging Markets Index (net div.)

|

-1.09

|

|

S&P Global ex US REIT Index (net div.)

|

-1.41

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

-4.21

|

|

As of 9/30/2018

|

|

US Stocks 1

World Market Capitalization—US (55%)

The US equity market posted a positive return, outperforming both non-US developed and emerging markets. Value underperformed growth in the US across large and small cap stocks. Small caps underperformed large caps in the US.

|

Period Returns (%)

|

QTD

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Large Growth

|

9.17

|

17.09

|

26.30

|

20.55

|

16.58

|

14.31

|

|

Large Cap

|

7.42

|

10.49

|

17.76

|

17.07

|

13.67

|

12.09

|

|

Marketwide

|

7.12

|

10.57

|

17.58

|

17.07

|

13.46

|

12.01

|

|

Large Value

|

5.70

|

3.92

|

9.45

|

13.55

|

10.72

|

9.79

|

|

Small Growth

|

5.52

|

15.76

|

21.06

|

17.98

|

12.14

|

12.65

|

|

Small Cap

|

3.58

|

11.51

|

15.24

|

17.12

|

11.07

|

11.11

|

|

Small Value

|

1.60

|

7.14

|

9.33

|

16.12

|

9.91

|

9.52

|

|

As of 9/30/2018

|

|

|

* Annualized

|

International Developed Stocks 2

World Market Capitalization—International (34%)

In US dollar terms, developed markets outside the US underperformed the US but outperformed emerging markets during the quarter. Large cap value stocks underperformed large cap growth stocks in non-US developed markets; however, small cap value outperformed small cap growth. Small caps underperformed large caps in non-US developed markets.

|

Period Returns (%)

|

QTD

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Growth

|

1.46

|

0.39

|

5.47

|

9.91

|

5.37

|

5.78

|

|

Large Cap

|

1.31

|

-1.50

|

2.67

|

9.32

|

4.24

|

5.18

|

|

Value

|

1.15

|

-3.43

|

-0.13

|

8.65

|

3.05

|

4.51

|

|

Small Cap

|

-0.85

|

-2.28

|

3.42

|

12.23

|

7.07

|

9.04

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Emerging Markets Stocks 3

World Market Capitalization—Emerging Markets (11%)

In US dollar terms, emerging markets posted negative returns for the quarter, underperforming developed markets including the US. The value effect was positive, particularly in large caps in emerging markets. Small caps underperformed large caps.

|

Period Returns (%)

|

QTD

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Value

|

3.44

|

-4.28

|

2.27

|

11.55

|

2.04

|

4.53

|

|

Large Cap

|

-1.09

|

-7.68

|

-0.81

|

12.36

|

3.61

|

5.40

|

|

Small Cap

|

-4.21

|

-12.30

|

-4.20

|

7.43

|

2.72

|

7.43

|

|

Growth

|

-5.38

|

-10.94

|

-3.89

|

13.03

|

5.08

|

6.18

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Select Country Performance

In US dollar terms, Israel, the US, and Sweden recorded the highest country performance in developed markets, while Ireland and Belgium posted the lowest returns for the quarter. In emerging markets, Thailand and Qatar recorded the highest country performance, while Turkey, Greece, Egypt, and China posted the lowest performance.

Real Estate Investment Trusts (REITs) 4

US real estate investment trusts outperformed non-US REITs in US dollar terms.

|

Period Returns (%)

|

QTD

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

US REITs

|

0.72

|

2.56

|

4.59

|

6.88

|

9.14

|

7.21

|

|

Global REITs (ex US)

|

-1.41

|

-2.88

|

3.39

|

5.66

|

4.18

|

5.40

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Fixed Income

Interest rates increased in the US during the third quarter. The yield on the 5-year Treasury note rose 21 basis points (bps), ending at 2.94%. The yield on the 10-year Treasury note increased 20 bps to 3.05%. The 30-year Treasury bond yield rose 21 bps to 3.19%.

On the short end of the yield curve, the 1-month Treasury bill yield increased 35 bps to 2.12%, while the 1-year Treasury bill yield rose 26 bps to 2.59%. The 2-year Treasury note yield finished at 2.81% after an increase of 29 bps.

In terms of total return, short-term corporate bonds gained 0.71%, while intermediate-term corporates returned 0.80%.

Short-term municipal bonds declined 0.11%, while intermediate-term munis dipped 0.06%. Revenue bonds (‒0.16%) performed in line with general obligation bonds (‒0.14%).

|

Period Returns (%)

|

QTR

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Bloomberg Barclays US High Yield Corp Bond Index

|

2.40

|

2.57

|

3.05

|

8.15

|

5.54

|

9.46

|

|

ICE BofAML US 3-Month Treasury Bill Index

|

0.49

|

1.30

|

1.59

|

0.84

|

0.52

|

0.34

|

|

ICE BofAML 1-Year US Treasury Note Index

|

0.41

|

1.07

|

1.08

|

0.74

|

0.55

|

0.71

|

|

FTSE World Gov't Bnd Index 1-5 Yrs (hedged to USD)

|

0.17

|

0.58

|

0.64

|

1.04

|

1.26

|

1.90

|

|

Bloomberg Barclays US Aggregate Bond Index

|

0.02

|

-1.60

|

-1.22

|

1.31

|

2.16

|

3.77

|

|

Bloomberg Barclays Municipal Bond Index

|

-0.15

|

-0.40

|

0.35

|

2.24

|

3.54

|

4.75

|

|

FTSE World Gov Bond Index 1-5 Years

|

-0.63

|

-1.68

|

-1.39

|

0.84

|

-1.16

|

0.88

|

|

Bloomberg Barclays US TIPS Index

|

-0.82

|

-0.84

|

0.41

|

2.04

|

1.37

|

3.32

|

|

Bloomberg Barclays US Gov't Bond Index Long

|

-2.82

|

-5.71

|

-3.50

|

0.78

|

4.41

|

5.45

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Commodities

The Bloomberg Commodity Index Total Return declined 2.02% in the third quarter. The energy complex led performance. Heating oil gained 5.63%, and Brent oil returned 5.21%. Nickel, the worst-performing commodity, declined -16.05%. Sugar lost -14.50%, and coffee fell -13.48%.

|

Period Returns (%)

|

QTD

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Commodities

|

-2.02

|

-2.03

|

2.59

|

-0.11

|

-7.18

|

-6.24

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Impact of Diversification 5

These portfolios illustrate the performance of different global stock/bond mixes and highlight the benefits of diversification. Mixes with larger allocations to stocks are considered riskier but have higher expected returns over time.

|

Period Returns (%)

|

QTR

|

YTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

10-Year STDEV

|

|

|

100% Stocks

|

4.40

|

4.26

|

10.35

|

14.02

|

9.25

|

8.77

|

15.83

|

|

|

75/25

|

3.41

|

3.56

|

8.14

|

10.64

|

7.08

|

6.85

|

11.87

|

|

|

50/50

|

2.43

|

2.82

|

5.93

|

7.31

|

4.89

|

4.78

|

7.91

|

|

|

25/75

|

1.45

|

2.05

|

3.71

|

4.01

|

2.68

|

2.58

|

3.95

|

|

|

100% Treasury Bills

|

0.48

|

1.24

|

1.50

|

0.75

|

0.45

|

0.27

|

0.14

|

|

|

As of 9/30/2018

|

|

|

* Annualized

|

Feature Article

Benefits of Diversification

An investor’s ability to achieve his or her investment goals often relies on maintaining a long-term, disciplined approach to diversification. Diversification across countries can help investors avoid potentially extreme outcomes that may result from a more concentrated approach. That said, a disciplined approach can also create frustration as performance fluctuates. Watching the short-term performance of individual markets may cause some investors to question the merits of diversifying across countries, and to consider reallocating to markets that have recently done well. But is that a good idea? Not if you consider the data.

For example, from 2010 to 2017, the SP&P 500 Index returned 13.92% while the MSCI ex-USA Index returned about 6%. Looking through this rear-view mirror, investors might be tempted to reallocate a larger portion of their capital to US stocks. But this decision could result in missed opportunities offered by global markets.

In fact, investors only need to look slightly farther back to see the swing of the pendulum. From 2000 to 2009, sometimes referred to as the “Lost Decade,” the S&P 500 recorded its worst-ever 10-year performance, with an annualized return of negative -0.95% versus the MSCI World ex-USA Index and the MSCI Emerging Markets Index which returned positive 1.6% and 9.8%, respectively. During this interval we also saw how the small cap and value premiums were present in markets all around the world. For example, the MSCI World ex-US Small Cap Value Index returned 9.40%, showing the potential benefits of tilting portfolios toward the dimensions of higher expected return when investing globally.

Nearly half the market opportunity lies outside of the United States. Non-US stocks including developed ex-US and emerging markets represent 43 countries and over 8,000 companies. However, during any one period, returns of any one country are difficult to predict. This lack of predictability reinforces the importance of global diversification so investors are positioned to capture returns wherever they occur.

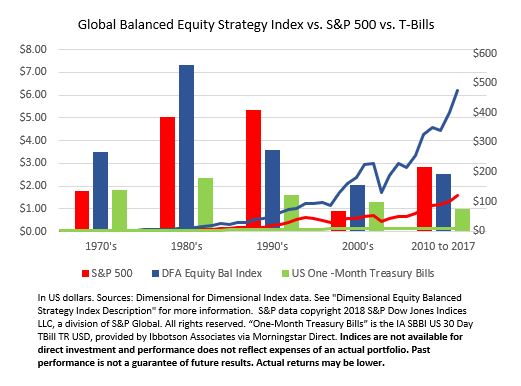

Looking at data over different time periods can offer perspective on the variability of investment outcomes. In the chart below we start with the 1970s, a decade in which DFA’s size-and-value tilted Global Balanced Equity Strategy Index outperformed the S&P 500 Index and US T-Bills. This trend continued in the 1980s, but the reverse was true in the 1990s. Because investment outcomes vary from one decade to the next, it’s important to consider the full sample of available data and maintain a long-term perspective when making capital allocation decisions. It’s true that the S&P 500 Index has been the leader more recently. But over the full sample of available data, the size-and-value tilted Global Balanced Equity Strategy Index delivered a significantly higher cumulative return than the S&P 500 Index. This reinforces the benefits of maintaining a globally diversified asset allocation.

Footnotes

1. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Cap Value (Russell 1000 Value Index), Large Cap Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Cap Value (Russell 2000 Value Index), and Small Cap Growth (Russell 2000 Growth Index).

2. Market segment (index representation) as follows: Large Cap (MSCI World ex USA Index), Small Cap (MSCI World ex USA Small Cap Index), Value (MSCI World ex USA Value Index), and Growth (MSCI World ex USA Growth Index). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI World ex USA IMI Index is used as the proxy for the International Developed market.

3. Market segment (index representation) as follows: Large Cap (MSCI Emerging Markets Index), Small Cap (MSCI Emerging Markets Small Cap Index), Value (MSCI Emerging Markets Value Index), and Growth (MSCI Emerging Markets Growth Index). All index returns are net of withholding tax on dividends. World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. MSCI Emerging Markets IMI Index used as the proxy for the emerging market portion of the market.

4. Dow Jones US Select REIT Index used as proxy for the US market, and S&P Global ex US REIT Index used as proxy for the World ex US markets.

5. Diversification does not eliminate the risk of market loss. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect expenses associated with the management of an actual portfolio. Asset allocations and the hypothetical index portfolio returns are for illustrative purposes only and do not represent actual performance. Global Stocks represented by MSCI All Country World Index (gross div.) and Treasury Bills represented by US One-Month Treasury Bills. Globally diversified allocations rebalanced monthly, no withdrawals.